It’s been a few months now since the Supreme Court has overturned the “Chevron Doctrine.” If you are a business owner, this may have interesting consequences for your business. Ambiguous federal statutes will now be met with higher judicial scrutiny. The courts now have the power to change the interpretation of any statute they deem ambiguous. Most interesting of all, the federal agencies will be forced to defend their interpretations of federal regulations.

Read MoreA new bill (Assembly Bill 977) has been signed into law by Governor Newsom and recently took effect on January 1, 2025. This new law increases the punishments for any person who assaults or batters a doctor, nurse, or other hospital worker in the emergency department from a maximum of 6 months to a maximum of one year imprisonment.

Read MoreMany U.S. employers use the H-1B Visa to obtain workers, and many employers have staffed nearly entire companies with such workers. It is a non-immigrant visa that allows employers to hire foreign workers in what is referred to as a “specialty occupation” for up to 3 years, with a maximum of 6 years. The Biden Administration took steps to “modernize” the H-1B program and the new regulation took effect on January 17, 2025.

Read MoreCalifornia employers are tasked with new notice requirements! Employers must give notice to all current and former employees employed after January 1, 2022 whose contracts included a noncompete clause (or who were required to enter a noncompete agreement) that such clauses or agreements are void. This notice must be given to the employees by February 14, 2024. The notice has to be individualized for each employee, in writing, and shall be delivered to the employee’s or former employee’s last known address and email address. This is a significant task and employers should plan their compliance ahead of time.

Fast food franchisees confirm that they will be increasing menu prices to offset the staggering increase in labor costs due to California’s new $20 minimum wage for all fast food workers. However, the California legislature, in establishing California’s new fast food worker minimum wage, may have failed to deliver high wages to California fast food workers. If the menu prices increase significantly, the fast food workers may find that their higher wages do not significantly increase their buying power at their own workplace- and perhaps in other areas of their life. In addition, if fast food franchisees choose to go fully automated and not hire employees, there are no higher wages for these workers because there will be no wages at all.

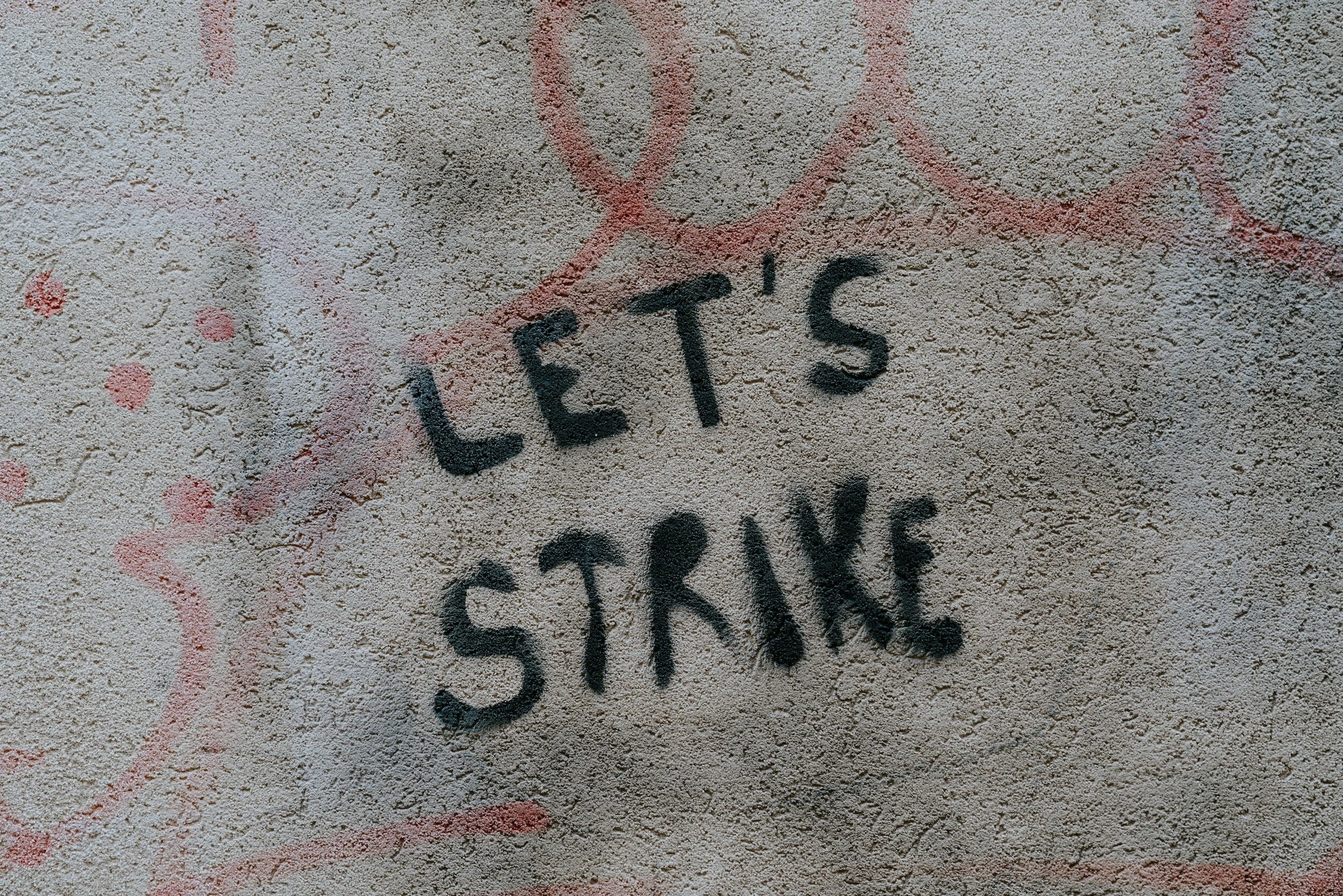

Read MoreUPDATE: Governor Newsom recently vetoed California Senate Bill 799, which would have provided unemployment benefits to employees who were not laid off and, instead, were choosing to go on strike.

Read More